SideShift.ai Weekly Report | 7th - 13th May 2024

Welcome to the one hundred and fourth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This week saw SideShift token move within the 7 day bounds of $0.1784 / $0.1825. At the time of writing, XAI is sitting at the very top of that range at a price of $0.1825, and has a market cap of $24,548,306 (+1.7%).

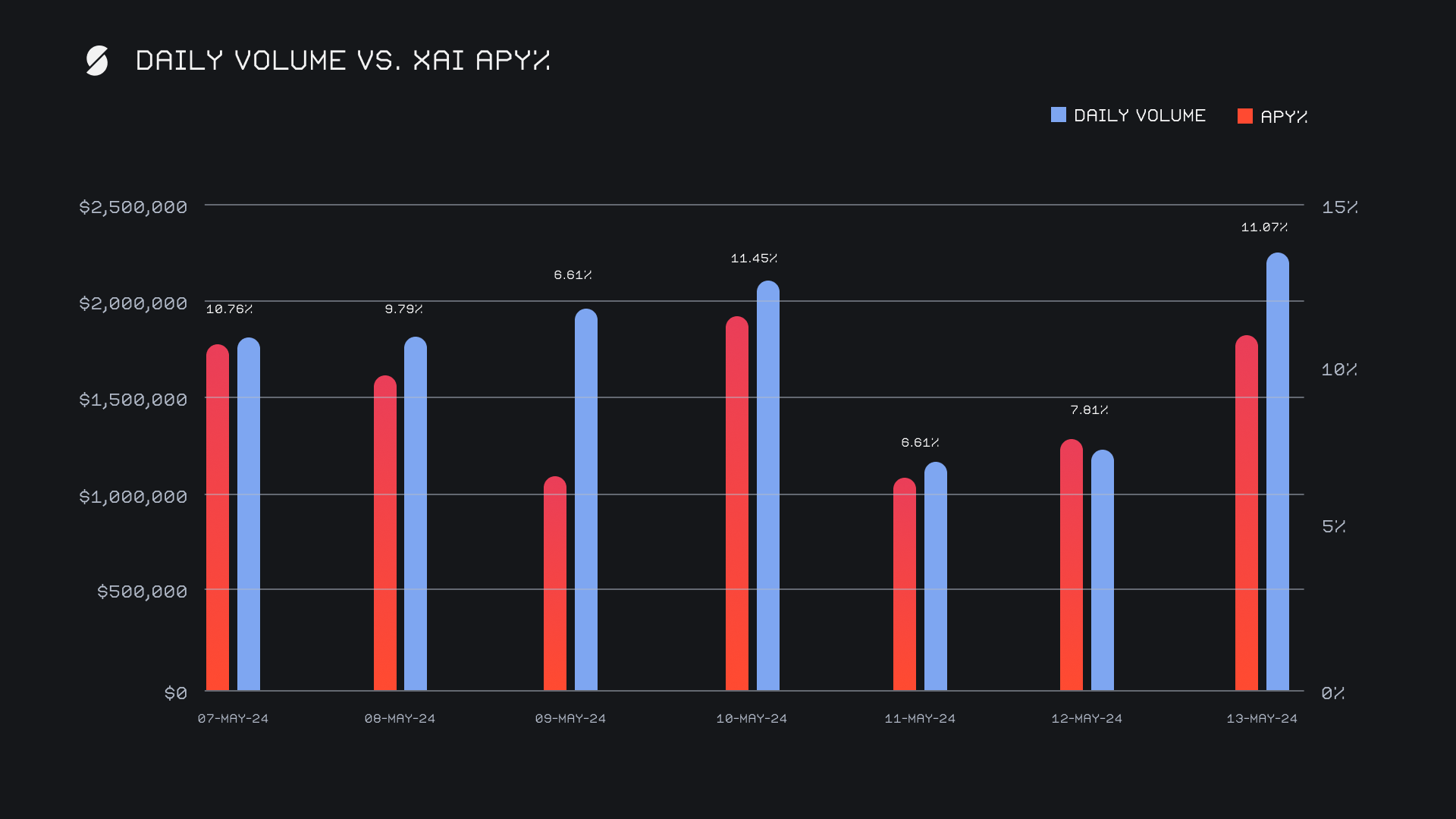

XAI stakers were rewarded with an average APY of 9.16% this week, with a daily rewards high of 35,557.36 XAI (an APY of 11.45%) being distributed to our staking vault on May 11th, 2024. This was following a daily volume of $2.1m. This week XAI stakers received a total of 212,013.95 XAI or $38,692.55 USD in staking rewards.

Users are encouraged to check out our SideShift staking articles to learn more about XAI staking, and are reminded that the easiest way to participate is to shift directly to svXAI, from any coin of your choice.

Additional XAI updates:

Total Value Staked: 119,856,883 XAI (+0.2%)

Total Value Locked: 21,721,982 (+1.4%)

General Business News

The underlying theme of the past week has been a mostly uneventful one, as ongoing sideways chop continues to play out. BTC saw a brief +5% jump towards the beginning of the week, only to see these gains retrace entirely the next day. The majority of the market has followed suit in this flip flop manner, with the exception of a few select coins such as TON and PEPE, which have broken to or are approaching all time highs.

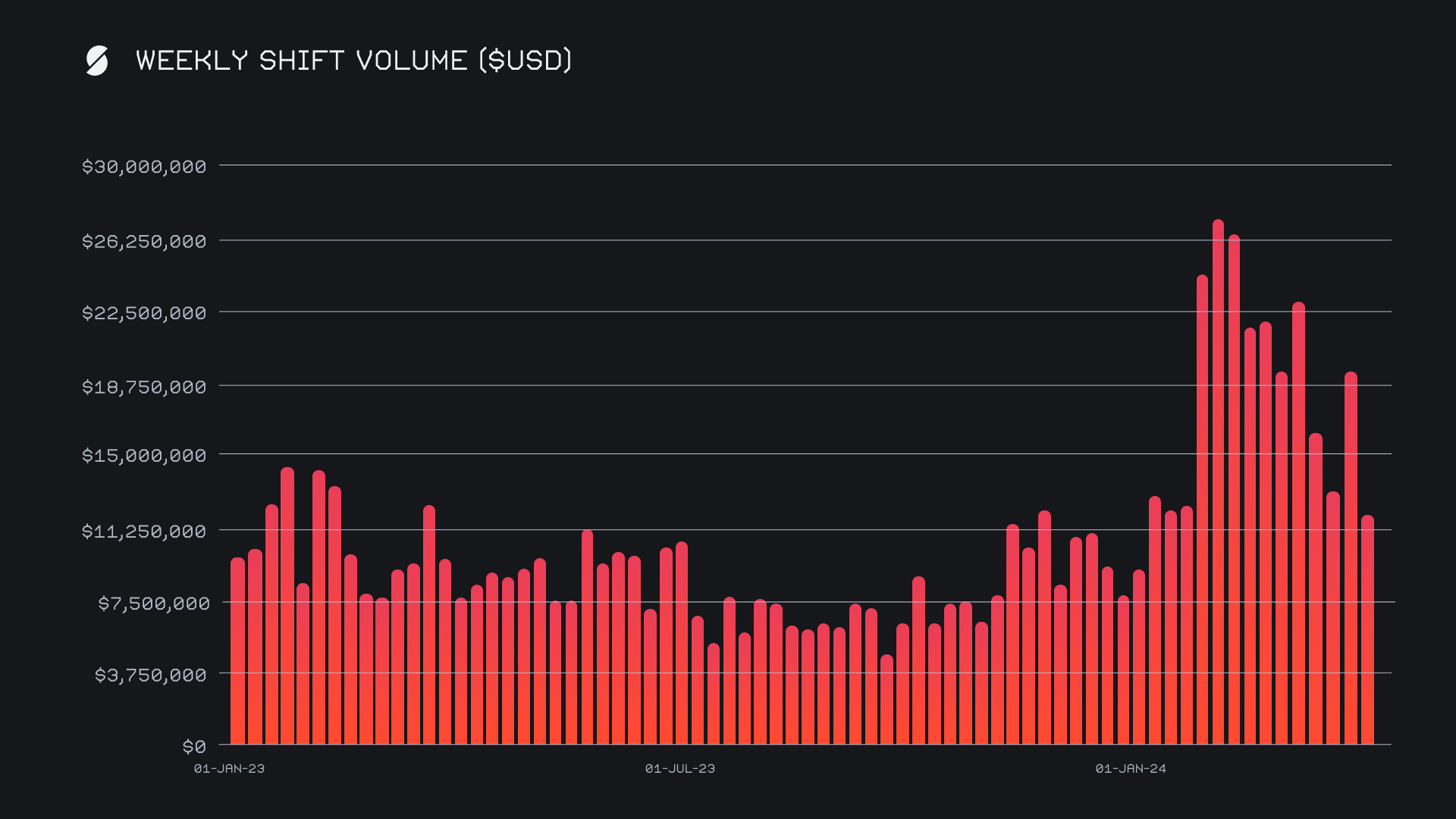

After a strong performance last week, SideShift felt the effects of the market’s sideways crabwalk. We ended the 7 day period with a gross volume of $12.4m, a weekly decline of -36.6% when compared to last week’s impressive $19.5m sum. This weekly volume occurred alongside a shift count which also fell, but by a far lesser extent and ended with a total of 8,837 (-6%). The relatively consistent stream of shift count despite the larger decline in volume is a representation of smaller shift sizes on average occurring this week. Together these gross figures combined to produce daily averages of $1.8m on 1,262 shifts.

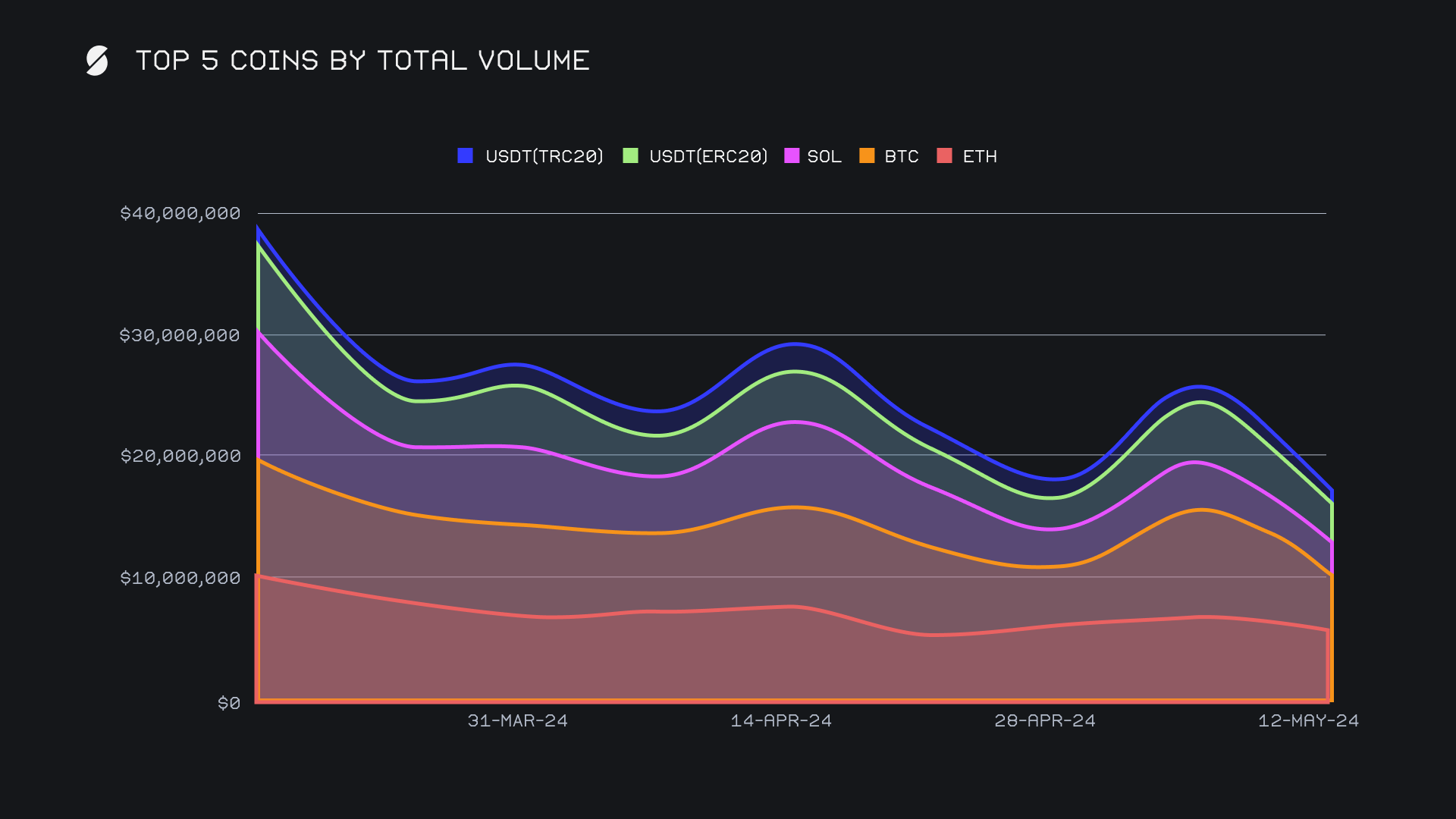

Aside from fifth placed USDT (trc20), the rest of our top 5 coins by total volume (deposits + settlements) noted a decrease in their weekly totals. Once again, this wasn’t overly surprising considering the comparison against a week which saw huge spikes in the shifting of our top coins. What was surprising however was the apparent lack of interest towards BTC, which was hit particularly hard and saw its total volume nearly cut in half. The result was a demotion to second place with a total volume of $4.6m (-48.8%), which came from a breakdown of $2.1m to $1.7m in user deposits vs settlements. User demand for BTC plummeted by -53%, resulting in the highest negative change for any of our top 10 coins, and was the main reason for its overall decline.

The indifference shown to BTC from users allowed ETH to position itself atop the list, although it too noted a decline in total volume. Still, with a total sum of $5.5m (-17%) ETH claimed the week’s top spot in an uncommon fashion, finishing nearly $1m higher than the runner up, BTC. Opposite to BTC, this was the result of a more or less consistent demand for ETH despite the sideways market. User ETH settlements had the lowest drop among top coins, falling just -11.6% for a total $1.9m, making it the most sought after coin on SideShift this week. In third place came SOL with $2.5m (-32.6%), which has been on a steady decline for the past 5 weeks, after achieving all time high volume on SideShift near the beginning of April. USDT (erc20) followed in fourth and had the most drastic change, falling -54.7% for $2.3m. Although user settlements outweighed deposits by a measure of $1.1m to just $446k, both of these two sides saw sizable weekly changes of -50% or greater. As a whole, our top 5 coins dipped to a 12 week low and fell back to levels seen prior to the March 2024 market surge.

It was an interesting week for stablecoins with their combined volume dropping by ~44%. However, a few still managed to see overall growth and ended as some of the only coins to achieve this feat this week. Whereas stablecoin leaders on the Ethereum network saw their volumes freefall by ~50%, to as much as 87% in the case of USDC (erc20), alternate choices on other networks actually enjoyed more shift action with respectable volume. Examples include the previously mentioned USDT (trc20), which rose +29.5% for $1.9m, as well as USDT (BSC), which spiked +49.3% for $949k.

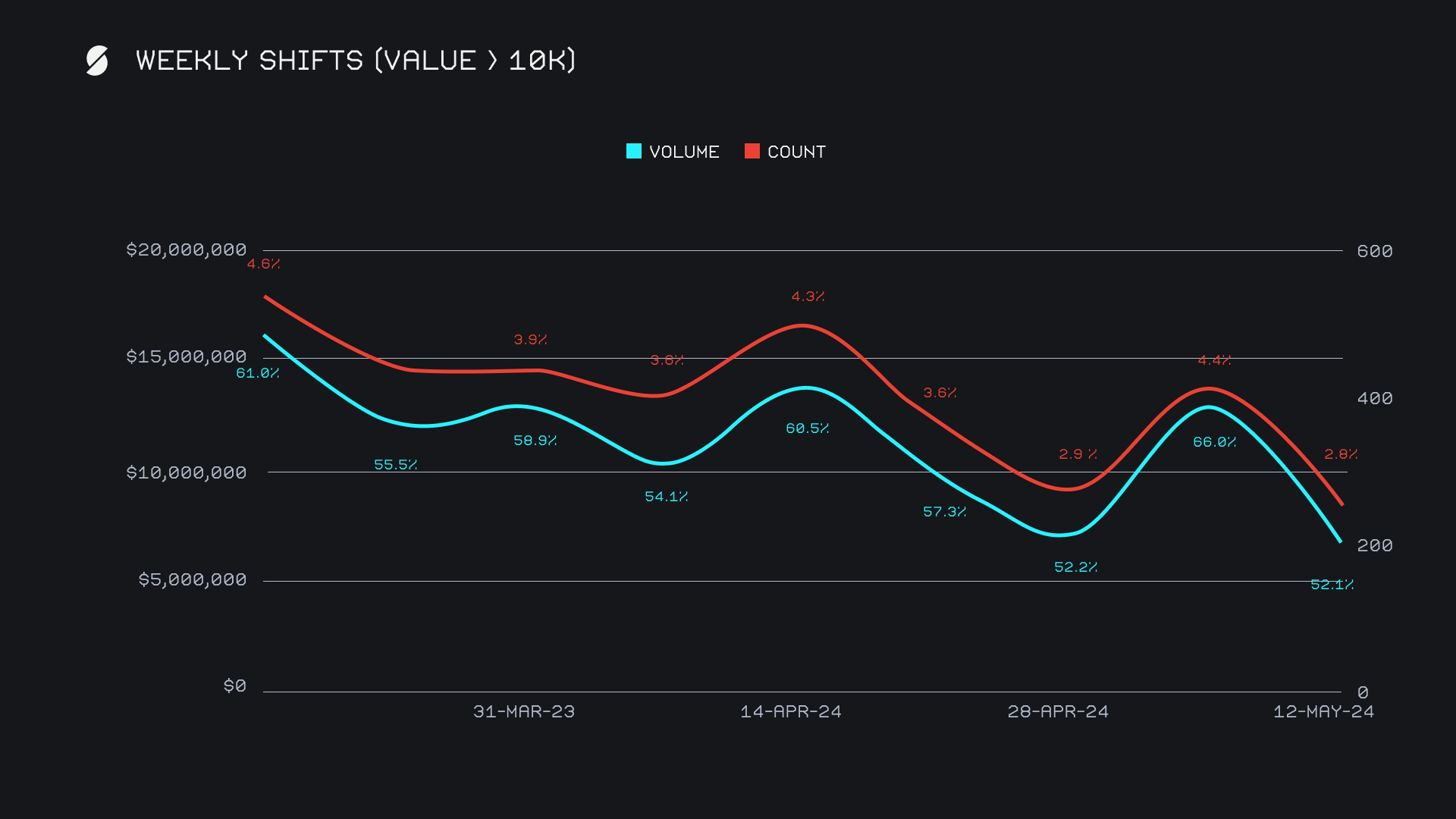

The overall impact of major stablecoins becomes quite clear in both the rise and fall of weekly shift volume. A significant reason for last week’s strong showing was the prevalence of large volume stablecoin shifting - similarly it proved to be a reason for the current week’s decline. We can see this impact when looking at shifts with a value greater than $10k, which have followed along with the rest of our charts falling to near 3 month lows. You can see this pattern outlined in the chart below, as shifts with a value >$10k accounted for just 52.1% of volume and 2.8% of count this week.

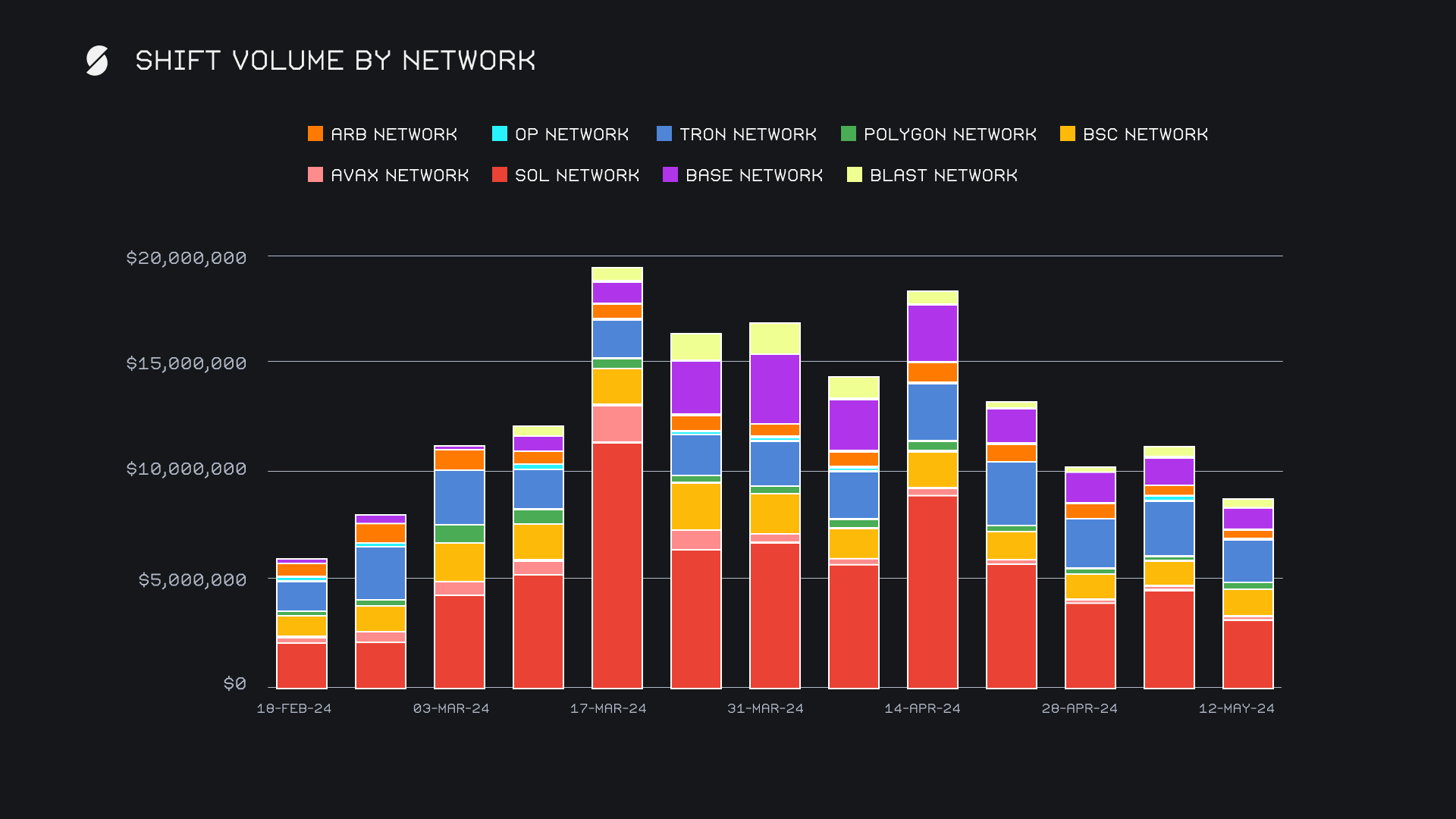

Alternate networks to ETH were no exception, and came together for a combined $8.7m (-21.6%). Although the Solana network still commanded the top spot with $3.2m (-29.9%), the Tron network proved to be more robust and declined by a lesser -12.7% for $2.2m. In third came the Binance Smart Chain (BSC) network with $1.3m (+11.6%), being the week’s only alternate network to enjoy an increase with decent volume. This was mainly thanks to the sudden interest in USDT (BSC). What we saw was a clear preference for the Ethereum network, as shifts on Ethereum were involved in 49% of our weekly volume as compared to a combined 35.2% for alternate networks.

Affiliate News

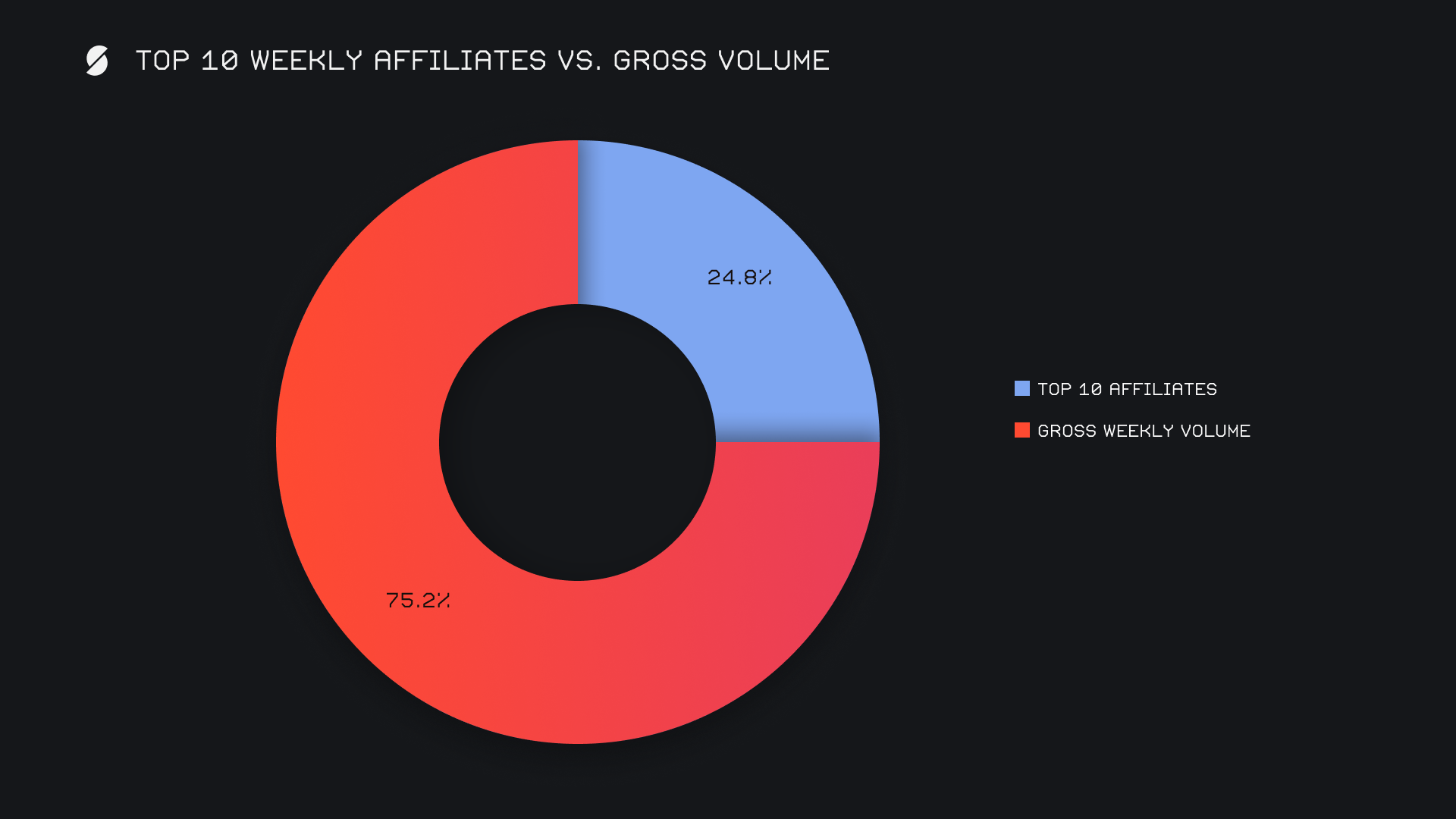

Our top affiliates ended with a total $3.1m, which was -44.2% lower than last week’s sum. Our usual top two affiliates were impacted quite hard, and saw respective volume declines of -75% and -41%. This allowed the previously third ranked affiliate to rise to first, doing so with a weekly volume of $1.0m on 290 shifts.

All together, our top affiliates accounted for 24.8% of our weekly volume, -3.4% lower than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.