SideShift.ai Weekly Report | 8th - 14th April 2025

Welcome to the one hundred and forty-ninth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

XAI’s price held in a tight formation over the past 7 days, with subtle swings between $0.1387 and $0.1406. Despite the lack of major volatility, the chart shows a consistent rhythm of short-lived climbs followed by quick pullbacks - a pattern that ultimately brought the token to its current level of $0.1396. Looking at the broader 30-day trend, XAI has gently eased down from its early April range above $0.142, settling into a narrower band as we enter the middle of April.

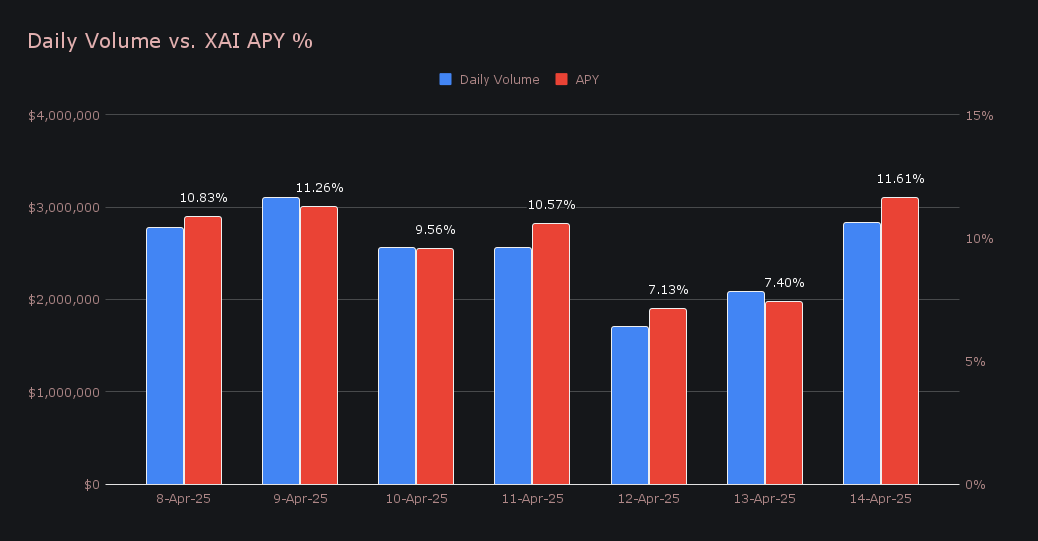

The token's market cap reflected this sideways action, closing the week at $20,476,535, a minor decrease of -0.85%. Stakers, however, continued to earn steadily, with an average APY of 9.77% throughout the week. April 15 saw the highest daily payout, reaching 39,767.62 XAI with an APY of 11.61%, backed by a volume of $2,823,724. All together, XAI stakers received a total of 235,710.22 XAI or $32,958.43 in rewards throughout the week, which were distributed directly to our staking vault.

Additional XAI updates:

Total Value Staked: 132,292,079 XAI (+0.2%)

Total Value Locked: $18,663,309 (+0.6%)

General Business News

This past week, BTC climbed +7.9% to $85.6k and ETH rose +5.1% to $1,644, as Trump’s unexpected 90-day pause on tariffs helped spark a broad rally. Traders began rotating into higher beta assets, sending SOL up +21.5% and fueling a memecoin comeback led by Fartcoin’s +58.9% surge into the top 100. The Fear & Greed Index rose to 31/100, hinting at a subtle but growing risk-on mood.

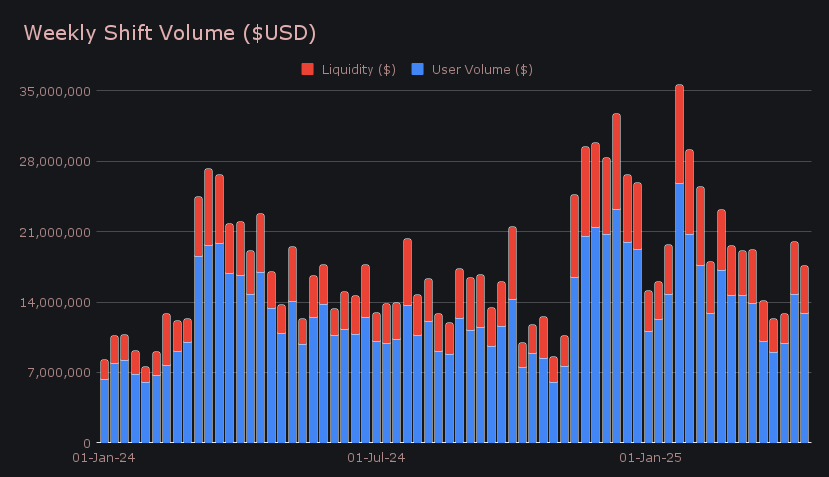

Shift activity remained steady, with total volume finishing at a respectable sum of $17.6m (-11.9%). Although slightly lower than last week’s elevated figures, both user and liquidity shifting continued at a consistent pace and totaled $12.9m (-13.2%) and $4.7m (-8.0%) respectively. Weekly volume ended -12.6% below our YTD average, but notably ahead of the lull observed in late March. BTC/USDT (ERC-20) retained its position as the top user pair for the fourth consecutive week with $1.2m in volume, despite a -36% drop in USDT (ERC-20) settlements, suggesting a general slowdown in stablecoin demand.

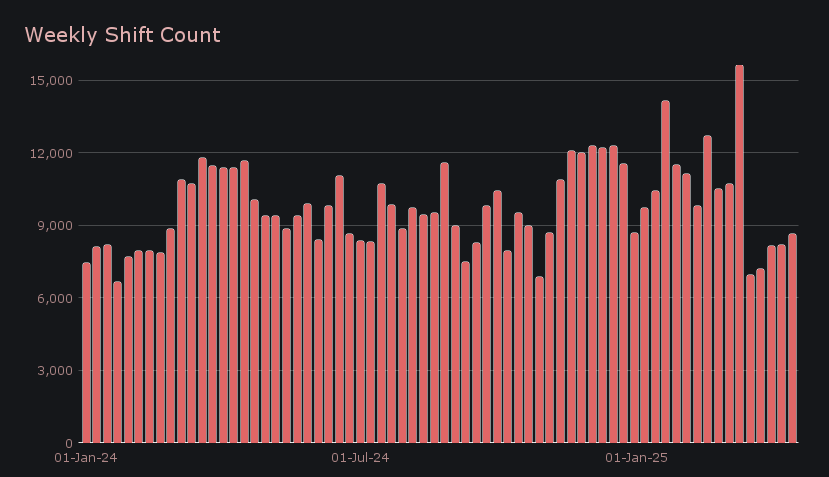

Meanwhile, our gross weekly shift count rose to 8,654 shifts (+5.9%), marking a modest rebound in overall activity. Despite the increase, this figure still sits -16.5% below our running YTD average, and reflects a more subdued pace compared to earlier highs in Q1. The rise in shift count this week was mostly driven by a broader base of smaller-sized transactions, which continued steadily throughout the week. All together, the week’s totals produced daily averages of $2.5m in volume across 1,236 shifts.

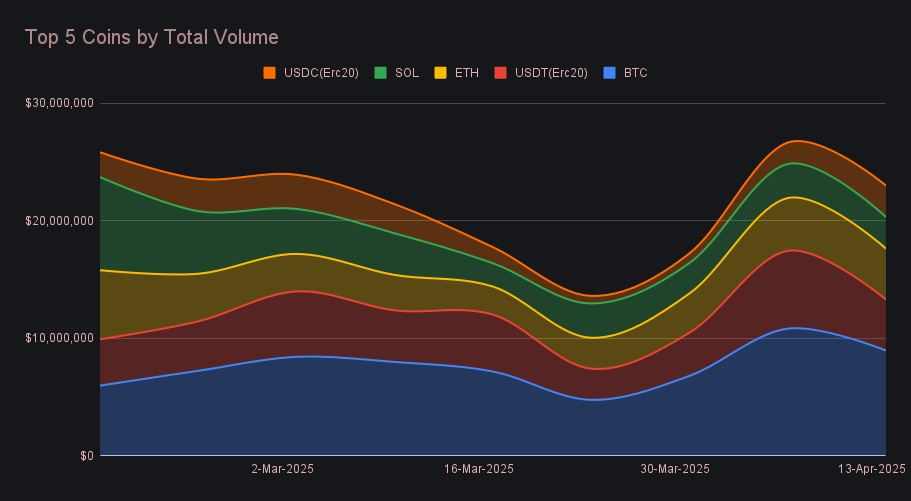

BTC remained firmly in first place with a total of $9.0m in volume (-17.2%), as users showed a strong appetite to accumulate. Although deposit volume dropped to $2.9m (-36.6%), settlement volume climbed to $4.1m (+3.4%), highlighting a clear lean toward users shifting into BTC rather than out. With prices climbing and sentiment improving, BTC’s role as the asset of choice among SideShift users showed no signs of fading.

USDT (ERC-20) followed in second place with $4.3m in volume (-34.5%), marking its third consecutive week in the runner-up spot. Deposit volume totaled $1.2m (-26.5%), while settlements fell to $1.9m (-36.3%), reflecting reduced stablecoin demand as users appeared more willing to rotate into market exposure. This shift was evident across the board, as total stablecoin volume declined by $2.09m and was involved in 50% of all shifts this week, as compared to a six-week high of 55% the week prior.

ETH rounded out the top three with $4.3m in total volume (-3.4%), far ahead of SOL, which ended with a lesser $2.7m (-7.1%). The two had remained neck and neck throughout March, but recent weeks have seen ETH begin to pull ahead. This week’s shift action supported that trend - while ETH deposits dipped to $1.7m (-22.0%), settlement volume climbed +25.5% to $1.5m, suggesting growing user demand. SOL, by contrast, saw more tempered activity, with deposits of $1.1m (-8.4%) and settlements of $1.0m (-5.7%), indicating that user engagement with SOL remains comparatively subdued.

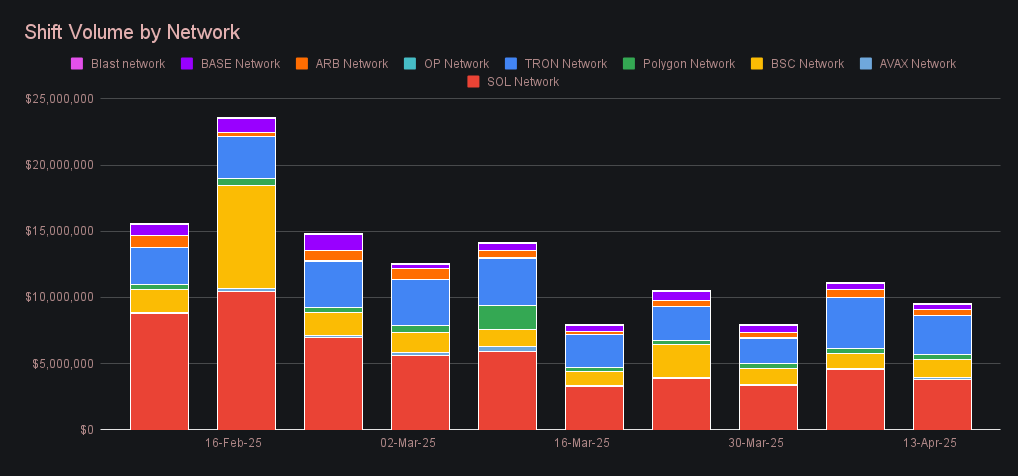

Activity among alternate networks to ETH remained concentrated this week, although most networks saw reduced totals. The Solana network continued to lead with $3.8m (-15.7%), despite a near halving in USDC (SOL) volume. The Tron network followed with $3.0m (-23.1%), marking a steep drop, but still maintaining the $3m mark and accounting for a sizable portion of alternate network volume. Meanwhile, Binance Smart Chain network rose to $1.3m (+16.1%) and reclaimed third place, driven by moderate gains in stablecoin-related shift activity. Further down the list, the Avalanche network rose +20% to $132k, while the Polygon network added +11.9% to end at $378k. These gains were not enough to offset losses elsewhere, however, and total volume across alternate networks to ETH fell to $9.5m (-14.7%). By comparison, the Ethereum network finished with $12.0m (-8.7%), expanding its relative lead and maintaining dominance for the time being.

Affiliate News

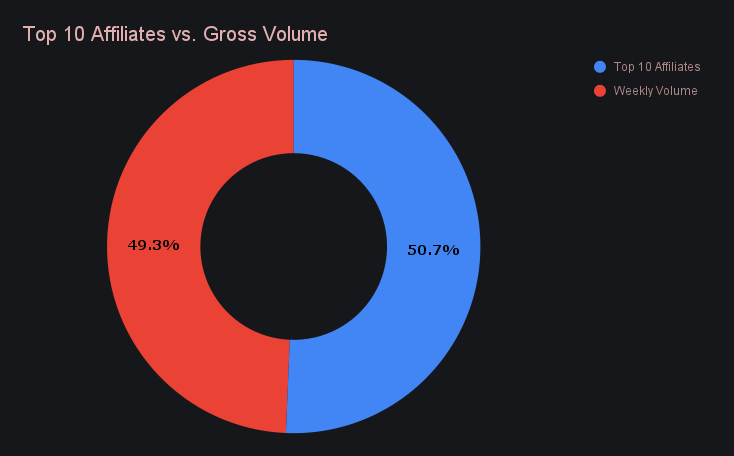

Affiliate shifting once again played a major role in sustaining SideShift’s overall volume, with our top affiliates combining for a substantial $8.9m. This marked the second consecutive week where affiliate contribution surpassed the halfway mark of total volume, ending at 50.7%. Leading the way was our top affiliate, which not only cracked $5m for the fourth time in 2025, but also recorded an outstanding shift count of 1,358 (+8.7%) - the highest of any affiliate this week. Meanwhile, our second-place affiliate still added close to $2m despite its weekly dip, and third place climbed +8% to $848k, rounding out a well-supported performance from all sides that helped anchor this week’s activity.

That’s all for now. Thanks for reading and happy shifting.