SideShift.ai Weekly Report | 8th - 14th October 2024

Welcome to the one hundred and twenty sixth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

This past week saw SideShift token (XAI) trade within a range of $0.1131 to $0.1188, with volatility peaking mid-week. On October 10th, XAI experienced a sharp dip, briefly falling to the lower end of the range before rebounding quickly the following day. XAI has since climbed steadily, closing at $0.1188 at the time of writing. This movement lifted its market cap to $16,621,827, marking a +4.5% increase from last week’s close of $15,912,523.

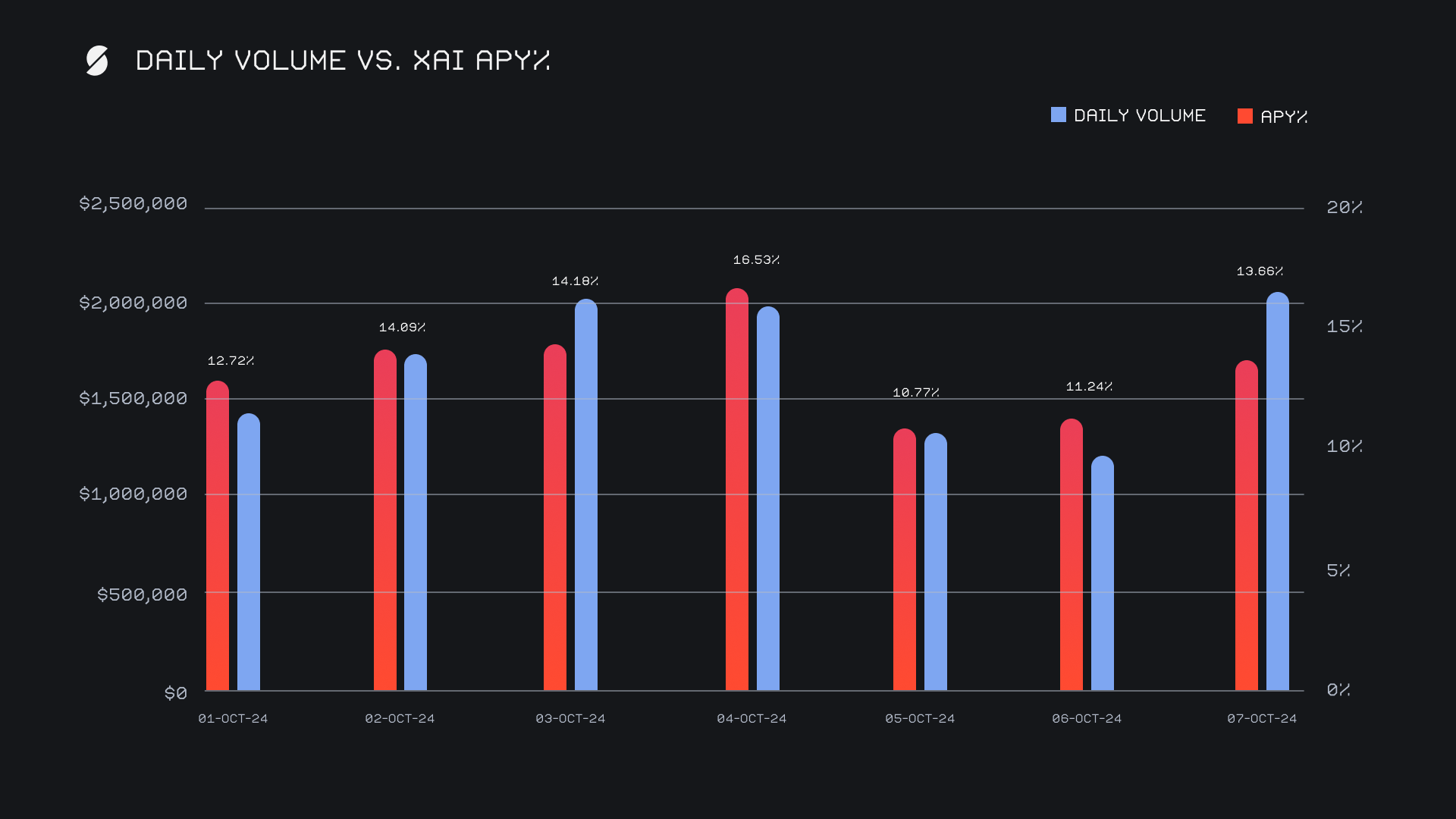

Staking activity remained vibrant throughout the week, with an average APY of 13.31% being awarded to XAI stakers. A daily rewards high of 54,852.07 XAI (APY of 16.53%) was achieved on October 12th and distributed directly to our staking vault, following a daily volume of $2.0m. All together, XAI stakers received a total of 299,885.30 XAI or $35,626.37 USD in rewards throughout the week.

An additional 2 WBTC were added to SideShifts treasury this past week, bringing the current total to a value of $14.69m. Users are encouraged to follow along directly with live staking updates, via sideshift.ai/treasury.

Additional XAI Updates:

Total Value Staked: 125,472,601 XAI (+0.2%)

Total Value Locked: $15,027,935 (+2.8%)

General Business News

This past week, BTC climbed toward $66k, looking poised to break out of an 8-month consolidation phase. All eyes are now on whether it can push beyond this key level, with momentum fueled by over $550 million in spot Bitcoin ETF inflows - the largest since June. ETH followed BTC’s lead, rising to $2.6k, while memecoins added excitement to the market with several posting double-digit gains amid growing bullish sentiment.

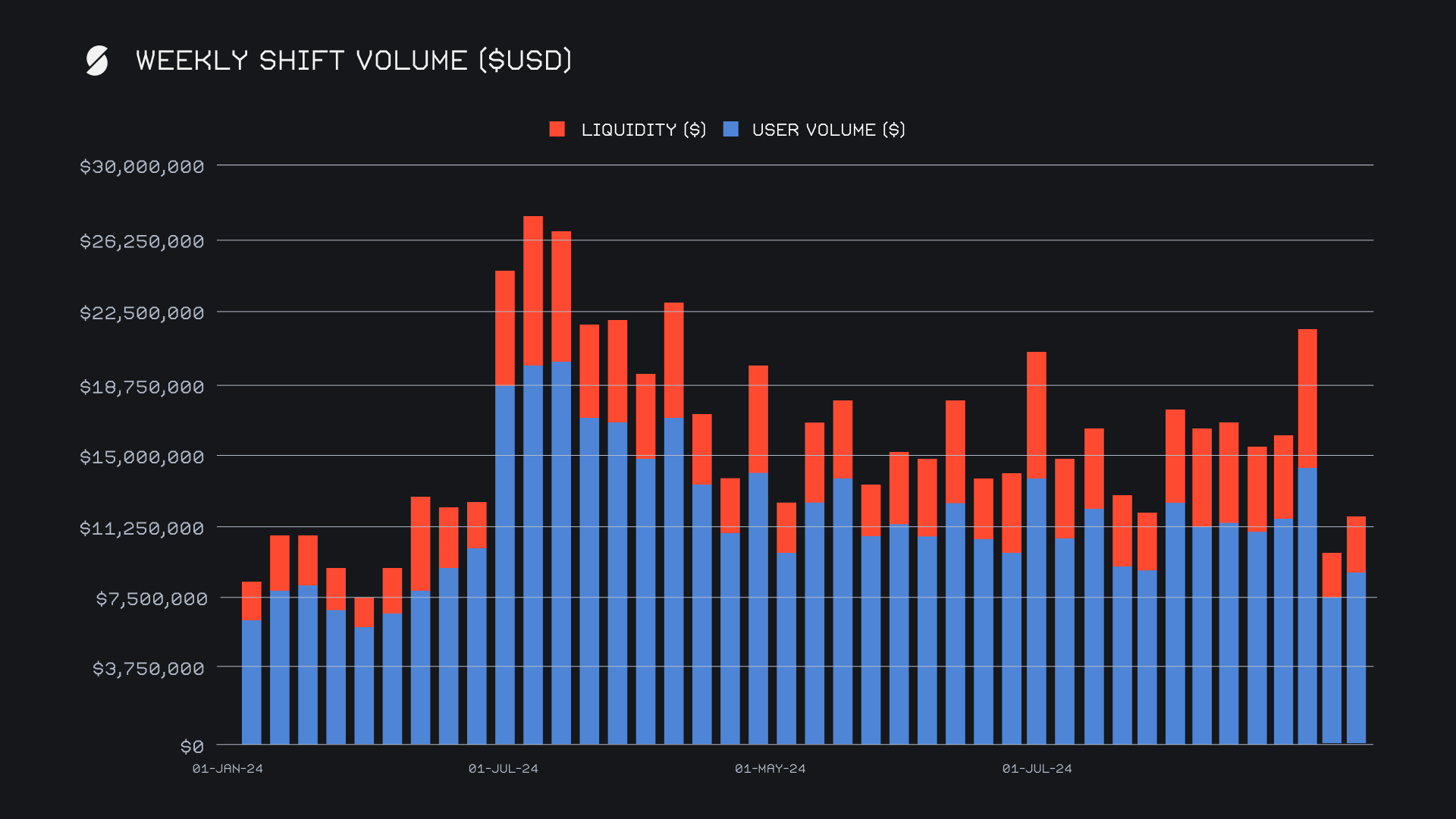

This past week, SideShift’s gross volume reached $11.7m, marking a solid increase of +18% from the previous week. Although still trailing the YTD average, volume rebounded strongly after dipping to local lows last week, signaling renewed shifting activity, particularly stemming from shifts made directly on the site. User shift volume climbed to $9.0m (+18.3%), with liquidity shifting rising at a nearly identical rate to $2.7m (+17.1%).

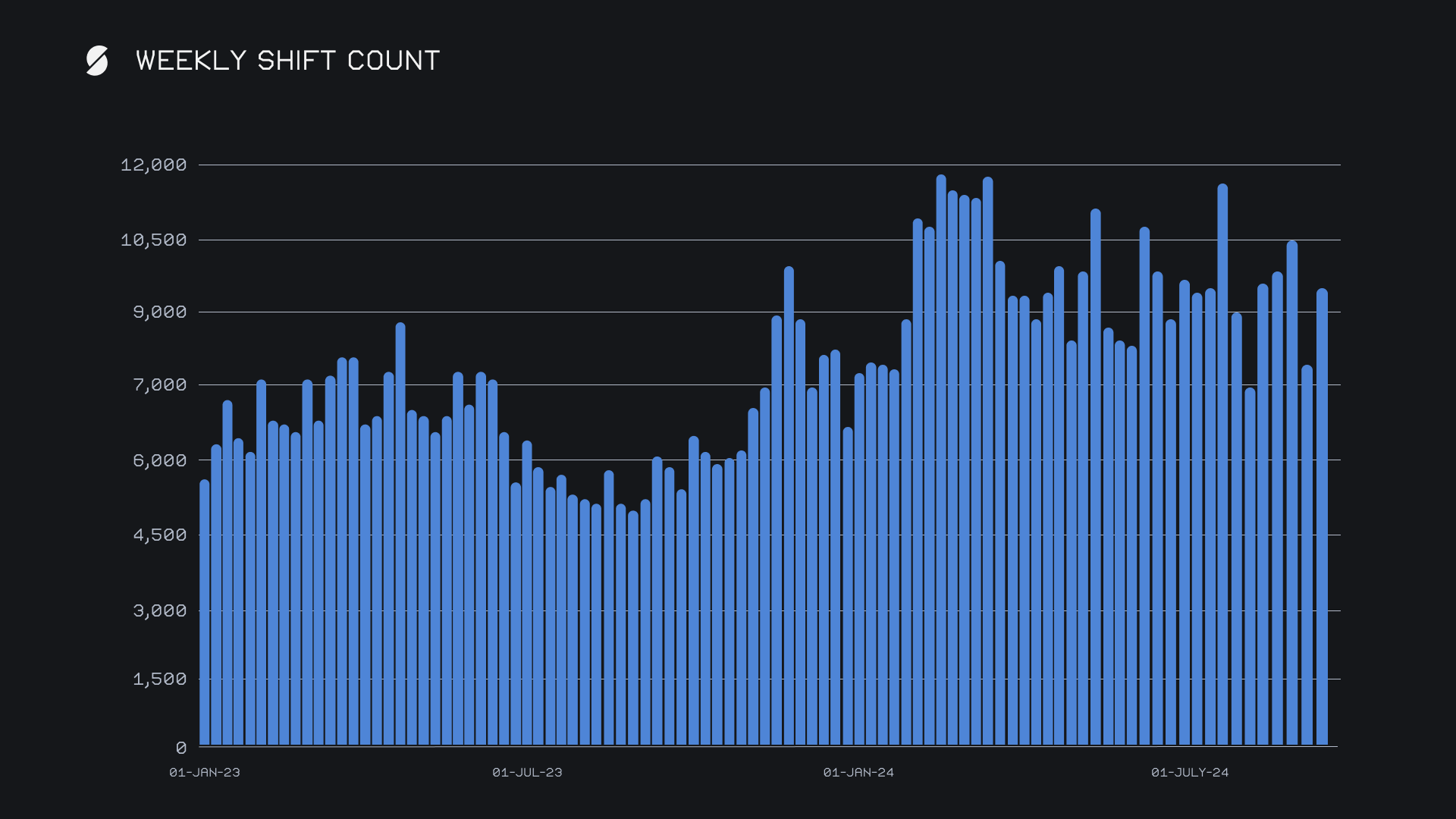

Meanwhile, our gross shift count carried on steadily and ended at 9,498 shifts, finishing within just +1% of our YTD running average. This was largely thanks to a constant flow of Solana network shifts throughout the week. SOL proved itself to be a key driver not only for shift count, but also volume. It ended in both of the week’s top two shift pairs among users, ETH/SOL with $982k and SOL/ETH with $836k. All together, our weekly volume and count combined to produce daily averages of $1.67m in volume across 1,357 shifts.

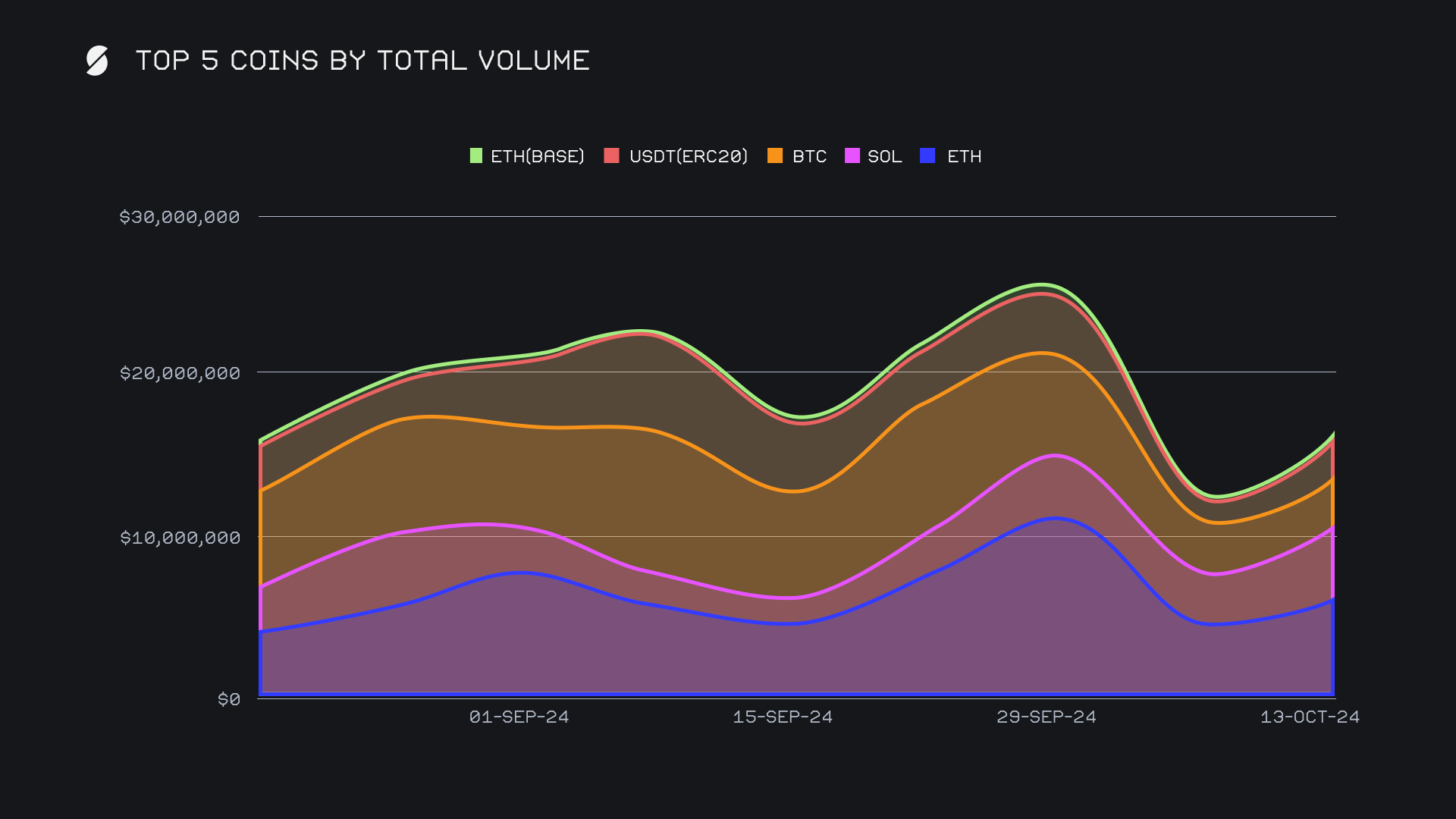

ETH retained its place as the top coin by total volume on SideShift for the third consecutive week, generating a total volume of $6.0m (+31.1%). The increase came from a notable rise in user deposits, which reached $2.4m (+51%), while settlements followed at $2.2m (+17.6%). ETH’s sustained dominance over the past weeks reflects a gradual shift in user behavior, as attention is increasingly turning toward it over the typical leader, BTC.

SOL followed behind, and recorded a significant $4.7m (+55.3%) in total volume. This marked the first time since March 2024 that SOL’s volume surpassed BTC’s on SideShift, reinforcing SOL’s growing relevance as of late. SOL settlements were particularly notable and matched ETH’s settlement activity by rising to $2.2m (+63.9%), while deposits totaled $1.6m (+39.4%).

Conversely, BTC slipped to third place with $3.1m (-10.3%), marking not only a decline for the week, but also shockingly representing its lowest total volume throughout all of 2024. The lack of interest was apparent across the board, with user deposits reaching $1.4m (-5.2%), while settlements summed just $906k (-8.7%). This dip reflects a noticeable pivot away from BTC and may represent a turning point in the attitude reflected by users, as the broader market continues to heat up.

When looking at coins outside of the top 3, we observed a couple of noteworthy trends. ETH (BASE) made a splash this week and surged into 5th place with $1.1m, a +269% jump from the previous week. SUI also extended its growth streak to seven consecutive weeks with volume reaching $938k, as user interest steadily builds alongside ongoing price appreciation. Meanwhile, USDT (TRC20) fell below $1m for only the fourth time this year and ended at $713k, its lowest total in 2024. This drop heavily impacted the performance of the TRON network, which has remained highly relevant throughout the entire year thanks to the previous consistency of USDT (TRC-20).

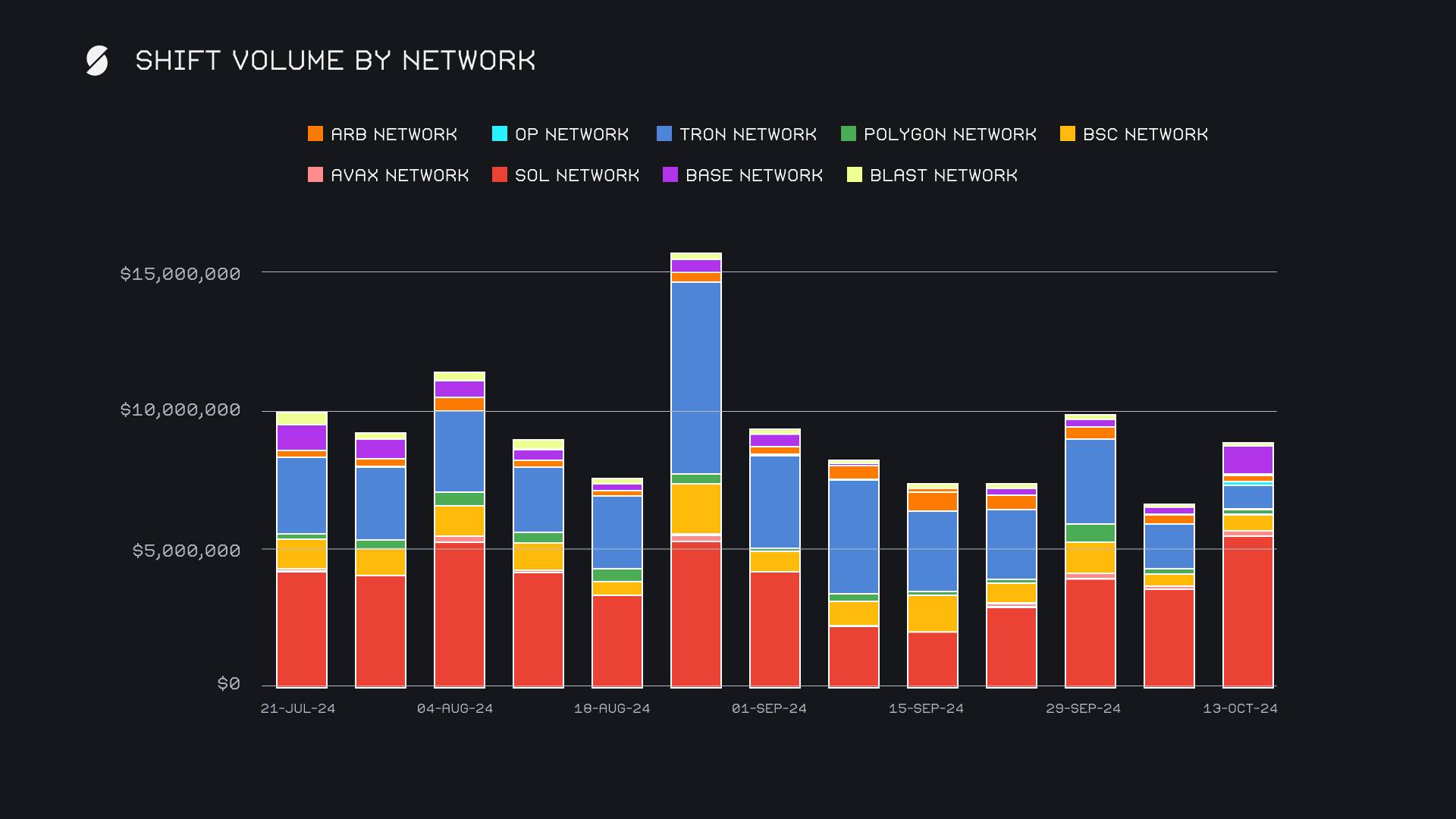

Regarding alternate networks to ETH, this week saw an uplift in shift activity across a handful of networks. Leading the way was the Solana network with an impressive $5.5m (+53.3%), cementing its position as the dominant network beyond Ethereum - this week, the Solana network sat just ~30% behind the total volume amassed by the Ethereum network. The Base network followed with $1.1m (+244.8%), marking a multi month high thanks to the sudden spike in ETH (BASE) shifting. The Binance Smart Chain (BSC) network came in third with a steady performance, finishing at $602k (+33.5%). In contrast, the Tron network saw a significant drop to $880k (-46.4%), due to the aforementioned drop in stablecoin shifting. Cumulatively, volume from alternate networks to ETH surpassed that of the Ethereum network this week, mainly due to the strong performance of Solana. Alternate networks combined to account for 37.8% of weekly volume, as compared to the Ethereum networks proportion of 30.7%.

Affiliate News

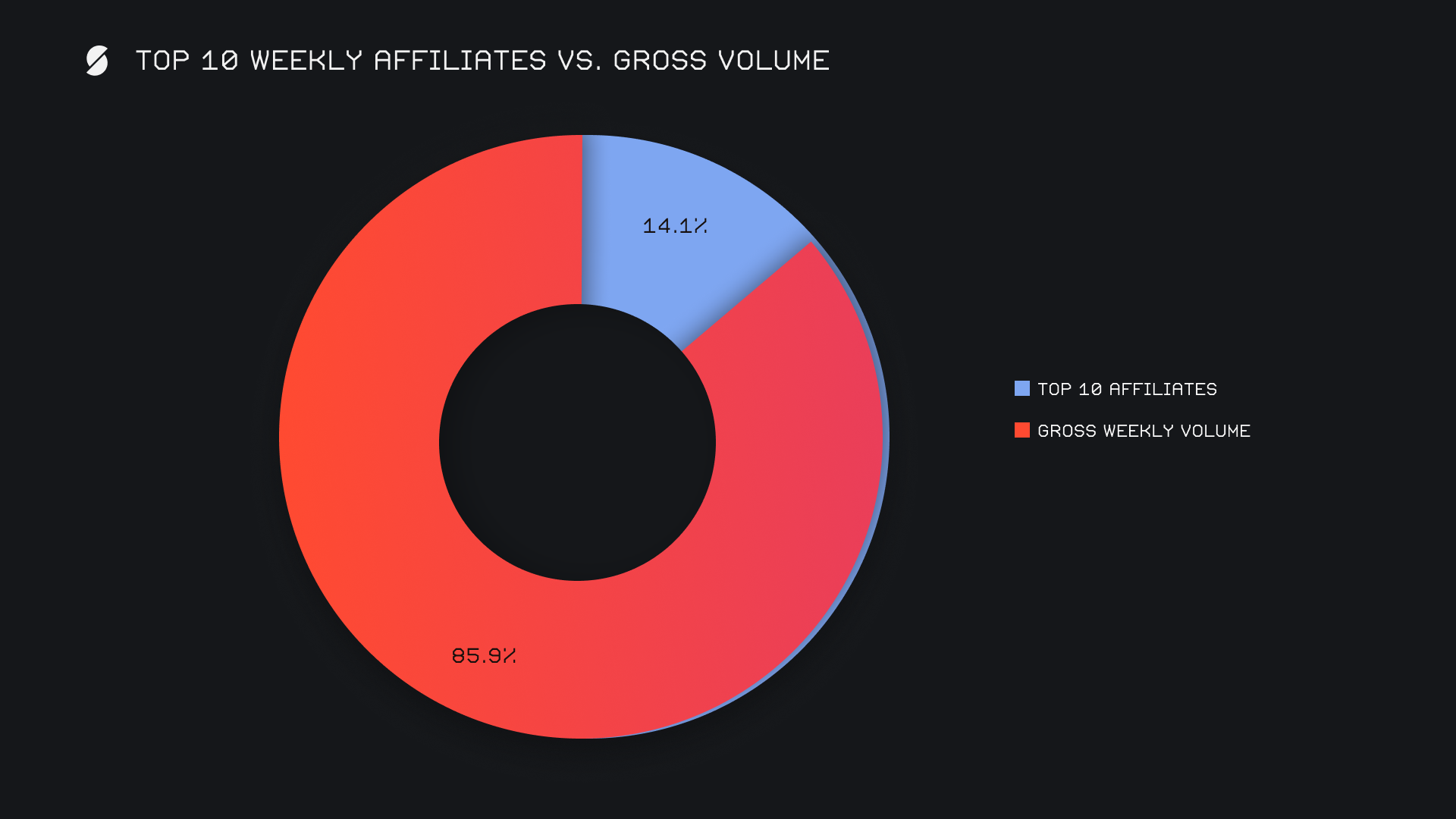

Our top affiliates combined for a total of $1.7m this week, reflecting a +24.9% increase from the previous period. Despite the rise in overall volume, affiliate performance remains relatively slow when compared to the stronger results seen throughout the year - this week’s rankings remain unchanged. Our first-place affiliate saw a slight dip, and finished the week with $617k (-5.6%). Meanwhile, our second-place affiliate more than doubled its volume to $468k (+119.1%), while our third-place affiliate posted steady gains, finishing at $249k (+46.1%). Altogether, our top affiliates contributed 14.1% of this week’s total volume, +0.7% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.