SideShift.ai Weekly Report | 9th - 15th April 2024

Welcome to the one-hundredth edition of the weekly stats report - your one-stop shop for all things SideShift.ai.

SideShift token spent the past week moving within the 7 day price range of $0.1781 / $0.1852, making a minor gradual decrease throughout the period as most of the broader market incurred a much sharper drop. At the time of writing the price of XAI is sitting at $0.1777 and has a current market cap of $23,610,355 (-7.1%).

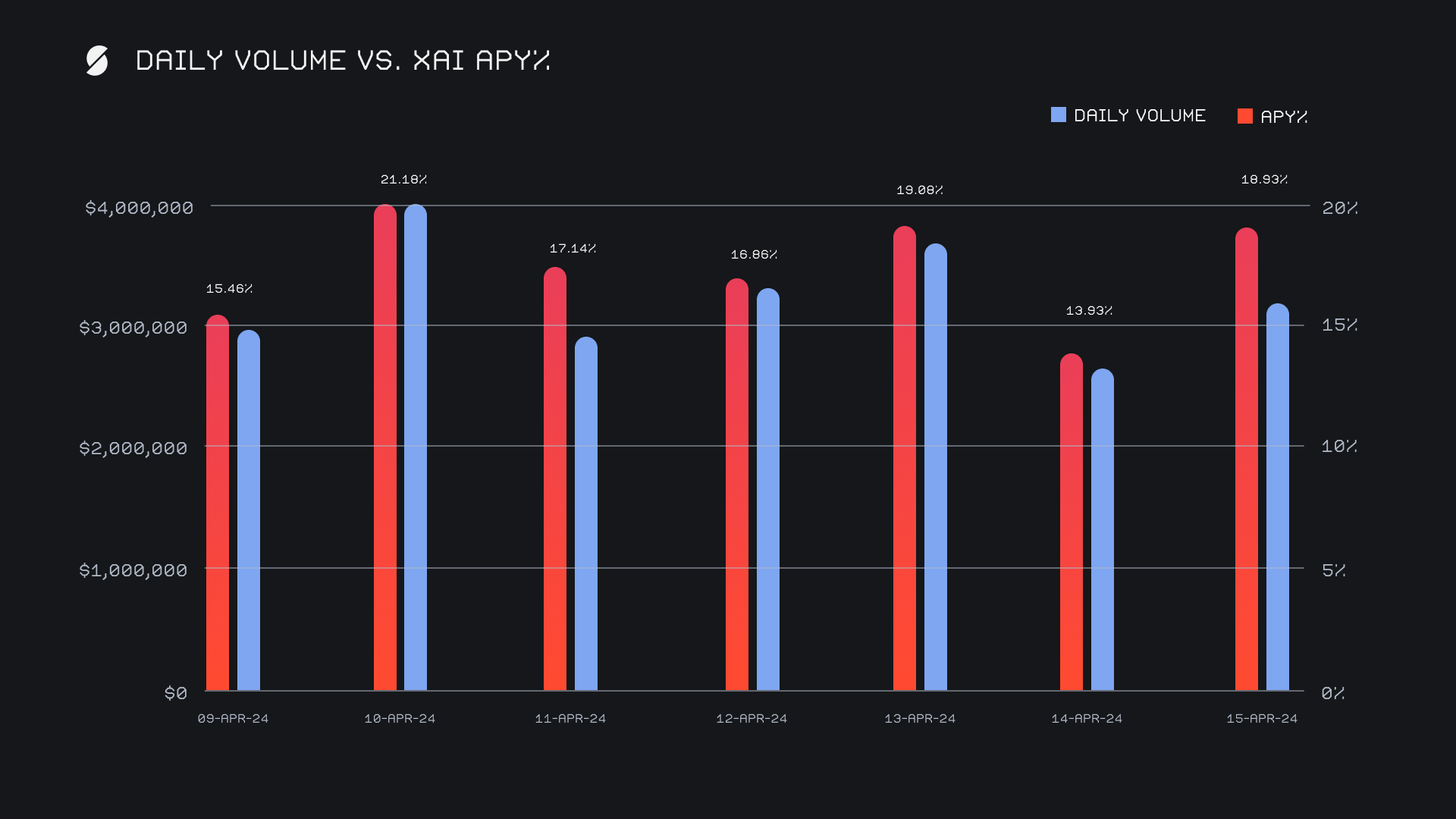

XAI stakers were rewarded with an average APY of 17.51% this week, with a daily rewards high of 62,372.01 XAI (an APY of 21.18%) being distributed to our staking vault on April 11th, 2024. This was following a daily volume of $4.1m. This week XAI stakers received a total of 366,621.48 XAI or $65,148.64 USD in staking rewards.

The price of 1 svXAI is now equal to 1.3192 XAI, representing a 31.92% accrual on stakers investments. A friendly reminder that the easiest way to participate in XAI staking is to shift directly to svXAI, from any coin of your choice.

Additional XAI updates:

Total Value Staked: 118,874,755 XAI (+0.3%)

Total Value Locked: $21,062,110 (-5.9%)

General Business News

A corrective week unfolded following several months of positive price action, resulting in BTC falling by more than -10%. Billions in liquidations of bullish bets caused a cascade that hit altcoins even harder, helping to reset market sentiment as we approach the upcoming BTC halving.

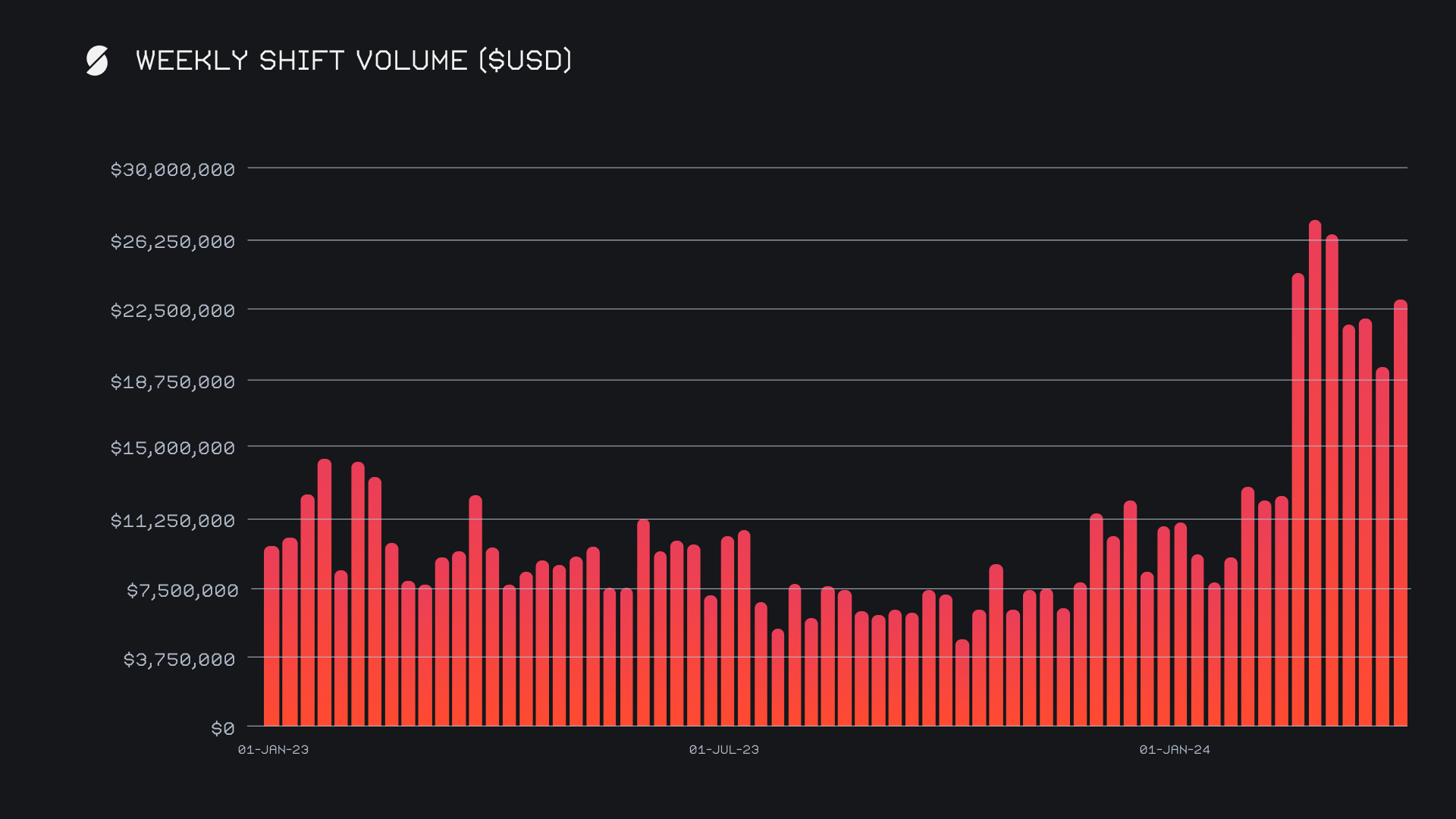

SideShift had a very solid week and capitalized on the market volatility, ending with a gross volume of $22.8m (+19.2%) alongside a shift count of 11,669 (+2.6%). Together, these gross sums combined to produce daily averages of $3.3m on 1,667 shifts. With that, SideShift has now maintained a weekly shift count which has exceeded 10,000 since the end of February, 2024. This week’s gross volume ranked as our fourth highest to date, with the top 3 occurring consecutively just last month - you can see this visualized in the chart below. Performances rose in unison across the board, with affiliate shifting rising at the same rate as shifts performed directly on the site.

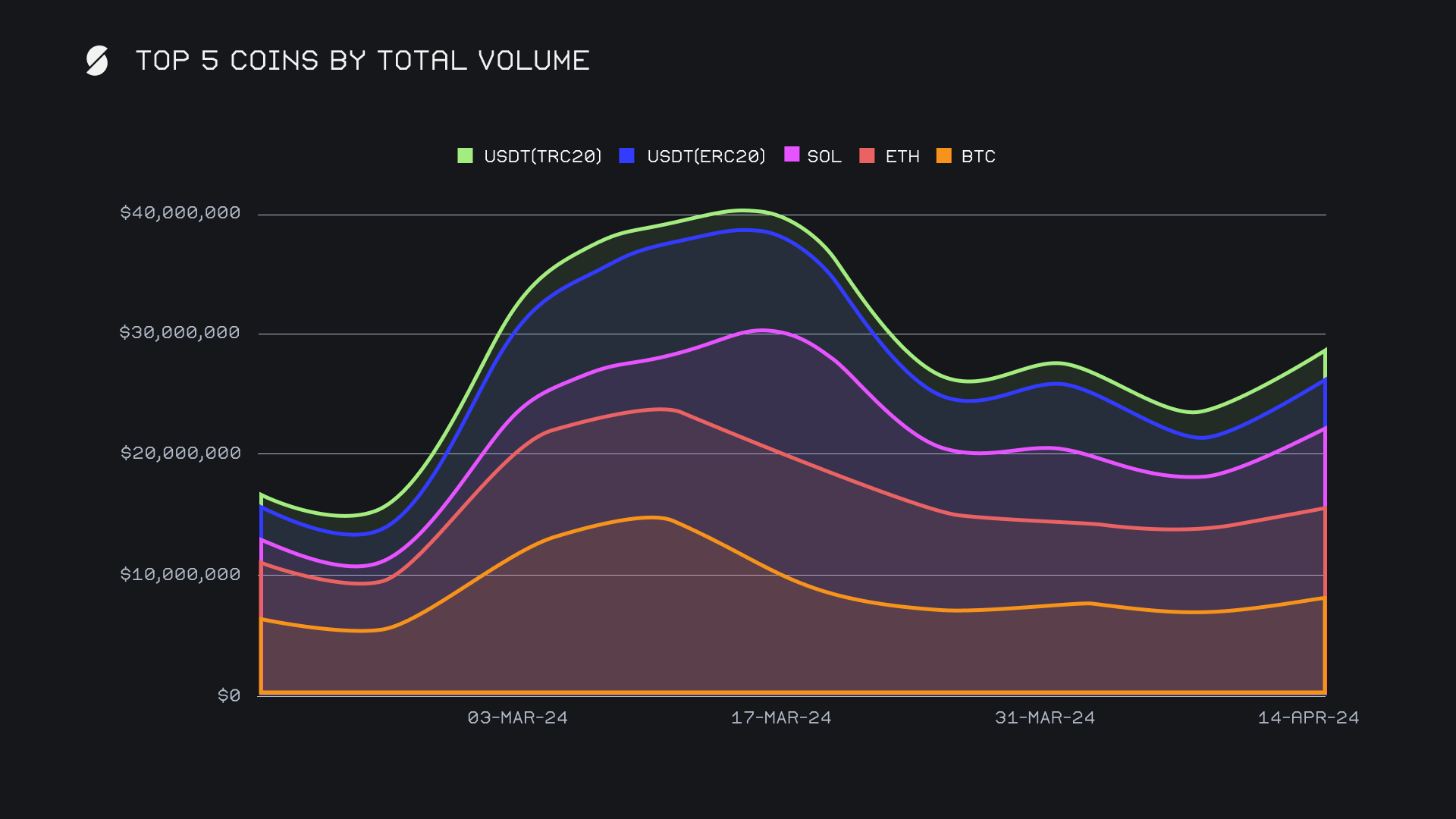

Our top 5 coins by total volume (deposits + settlements) all enjoyed an increase in their weekly sums, with third placed SOL seeing the highest change at +69%. Regaining its position at the top was BTC, which leapfrogged ETH with a total volume of $8.5m (+24.7%). While user BTC deposits remained relatively consistent at $3.1m, user settlements jumped +56% to end with $3.8m. This was enough to secure the title of the most demanded coin for the week, possibly a sign of users scooping up the dip and securing some cheaper Bitcoin. Coming in second was ETH, which continued on rather steady and increased by just +2.2% for a total $7.3m. Similar to BTC, the breakdown for ETH favored user settlements to deposits, as these two halves had respective sums of $3.4m and $2.4m.

The anomaly this week was third placed SOL, which ended just shy of ETH with a total volume of $7.2m (+69%). This breakdown however went against the grain of our top coins and saw a massive influx of user deposits. User SOL deposits spiked by +90% to finish with $3.5m, making it the most deposited coin of the week. This compares to a settlement total which sat at less than half that of deposits, with a sum of $1.5m. This heavy deposit action is likely a reflection of users rushing to exit SOL as the price tanked, fleeing to the safety of top coins BTC and ETH. This also coincided with ongoing network congestion for Solana, an issue that impacted the chain throughout the entire week. Further support for this was the week’s most popular shift pairs by users - SOL/BTC ranked first with $1.24m, followed by SOL/ETH with $1.17m. ~70% of the deposited SOL volume this week was shifted to these two coins alone.

Another interesting observation brought forth by the market lull was the overall increase in user stablecoin deposits. A combined sum of $3.9m marks a 3 month high for user stablecoin inflows, perhaps another sign of users buying the market dip. A handful of stablecoins saw their deposit volume more than double - top stablecoin USDC (ERC-20) saw its deposits rise +102% for $555k, while less popular USDT (SOL) had deposits explode more than 13x for $453k. USDC (BASE) was another example, with deposits increasing +260% for $231k.

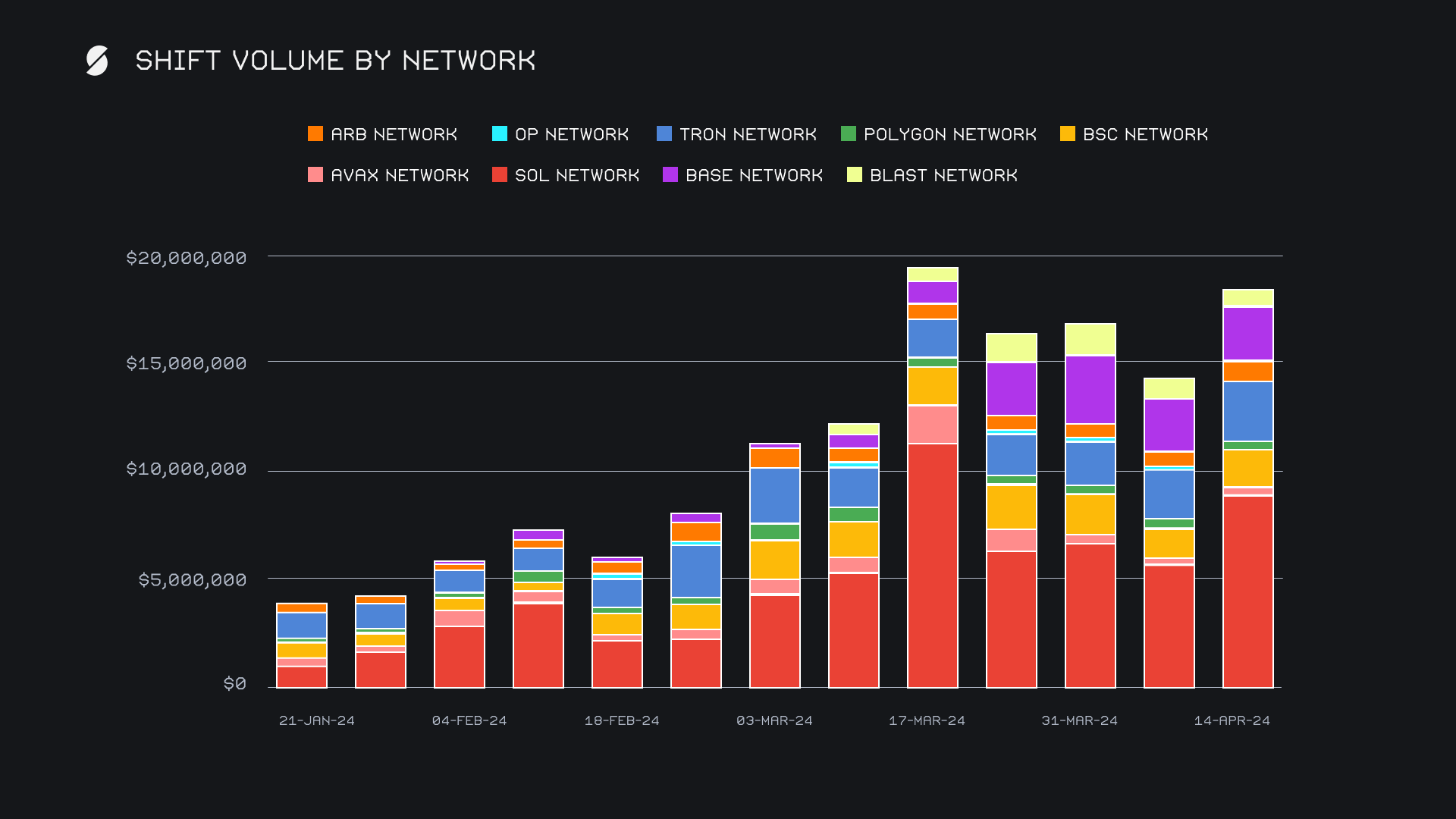

The boost in shift action for SOL contributed to alternate networks to ETH combining for one of their best weeks ever. The result was the biggest ever discrepancy between total Ethereum network volume and alternate networks to ETH - shifts on Ethereum accounted for 28.5% of weekly volume, while alternate networks represented a dominant 40.3%. Unsurprisingly, the Solana network led this grouping with an impressive $8.9m (+55.2%). The native SOL token and USDT (SOL) comprised the vast majority of this sum, with far less interest being shown to the more volatile SOL tokens at the moment. Also noteworthy was the shift count of the Solana network, which ended with 3,548 on the week, a sum twice as high as the next closest. In second place came the Base network with $2.7m (+8.9%), further cementing its newfound place among the top alternate networks on SideShift. The Tron network trailed very closely behind in third place with $2.6m (+14.3%), thanks to the always dependable shift volume coming from USDT (TRC-20). The Blast network was one of only two alternate networks to see a decline this week, as it dropped -34.5% for a total $612k. Despite the decline, it still outperformed the Avalanche, Polygon and Optimism networks.

Affiliate News

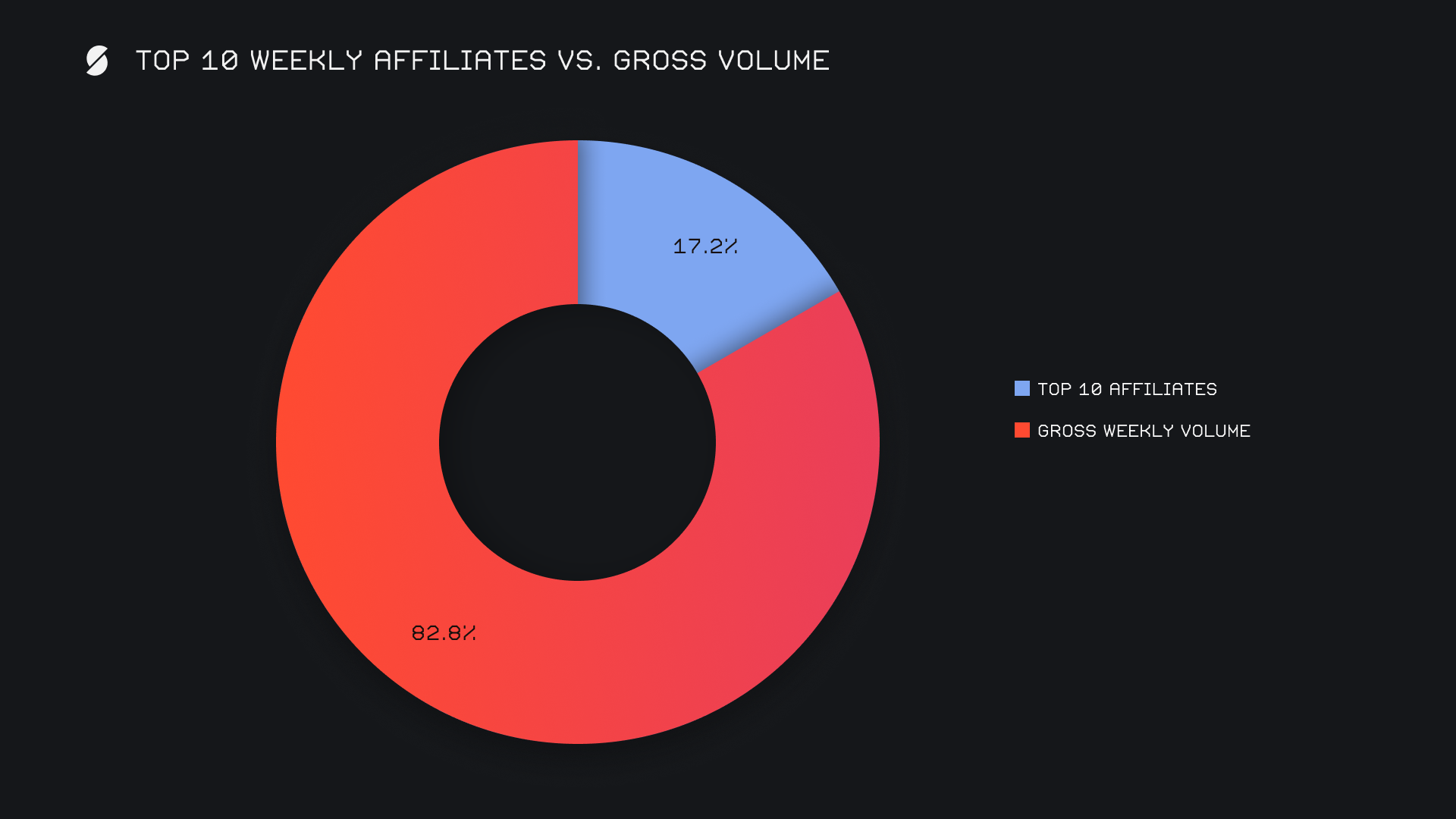

SideShift’s top affiliates combined for a total $3.9m (+19.9%), particularly due to solid performances from our top 3 affiliates. All of them saw double digit growth on the weekly timeframe, with our top affiliate having the biggest change of +28%, thereby leading to a gross volume of $1.5m. Second and third place followed suit with respective sums of $1.2m and $727k. As previously mentioned, summed volume for our top affiliates essentially rose at the same rate as our overall gross volume, meaning their weekly proportion remained the same.

All together, our top affiliates accounted for 17.2% of our weekly volume, just +0.1% higher than last week’s proportion.

That’s all for now. Thanks for reading and happy shifting.